Time now for a quick round-up of what

has been happening in the sales & lettings market in the Warrington area

throughout the last 3 months to date. (figures obtained from Rightmove and do

not include private lets):

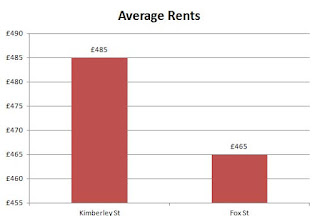

You can see from the rental figures above,

that it is 1, 2 and 3 beds that are most in demand, with 2 beds being the

most popular, now if we look back at the last quarterly update it was the 3 bedrooms

that were the most popular so there is a slight change in demand in a short

space of time, I find that 2 and 3 bedroom houses for rentals are always the

ones in high demand in Warrington. 3 bedrooms usually attract most interest +

least void periods.

If you look at sales, it seems 1, 2, 3

& 4 beds are what people want to buy, this time it is 3 beds that win the

race just like the previous quarter.

So, as an investment, what should you buy?

Well demand is there to rent anything up to 3

bedrooms, but there are already a high number of potential private purchasers

chasing those same properties, so this will inevitably increase pressure on

availability and start to drive prices up, whereas 2 beds are in a lot less

demand by purchasers, yet these are often prized by renters. Our experience

here tells us that 2 beds will always find a rental market, they will always

rent out quickly but there will be more churn (turnover of tenants), and these

will command a slightly higher yield than 3 beds.

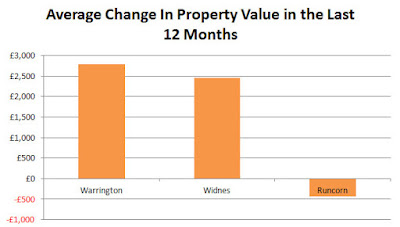

However, for families wishing to rent, 3 beds are a

must, and in the catchment area of great schools (particularly secondary) they

will always be in high demand and with less churn, and it is these properties

that tend to offer better scope for capital growth in the long term whilst

providing a steady yield of around 6-7.5% yield today.

If you are thinking of getting into the property

rental market and don't know where to start, speak to us for impartial advice

and guidance to get the best return on your investment. For more information

about other potential investment properties that we could introduce you to, or

to ask about our thoughts on your own investment choices, call us now on 01925

235 335 or pop along and speak to us in person at our office at 6

Bankside, Crosfield Street, you can always email me on manoj@hamletwarrington.co.uk

Dont forget to visit the links below to view back dated deals and Warrington Property News.

Twitter,https://twitter.com/HHWarrington